b&o tax form

You can find additional contact information for the Finance Department under our Contact Us section. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax.

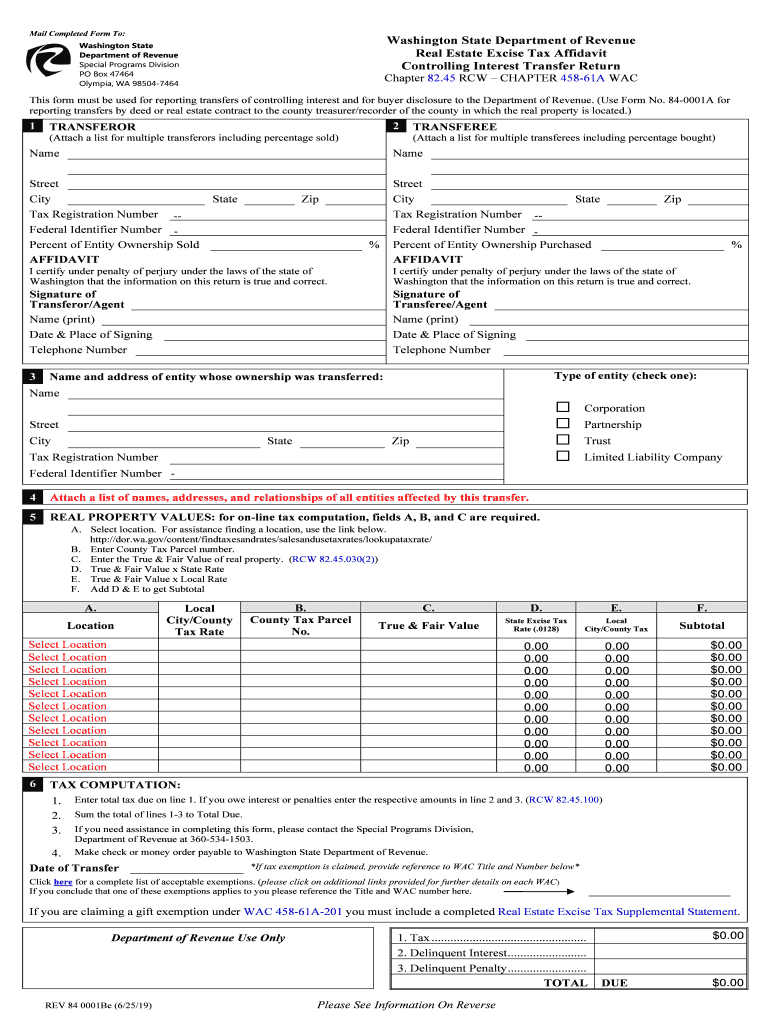

Wa Dor 84 0001b 2019 2022 Fill Out Tax Template Online Us Legal Forms

Washingtons BO tax is calculated on the gross income from activities.

. Business Occupation Tax Information. Washingtons BO tax is reported and paid on the excise tax return or by filing electronically. The tax amount is based on the value of the manufactured products or by-products.

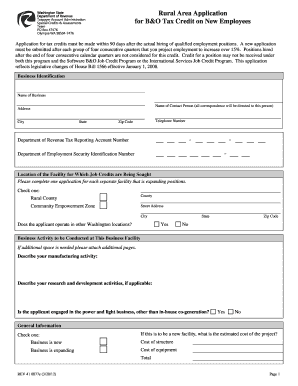

The Business Tax and Fee Division and the Field Operations Division are responsible for administering Californias state local and district sales and use tax programs which provide more than 80 percent of CDTFA-collected revenues. Job Credits - You can receive a 500 BO tax credit every year for five if you. Zero tax due forms may be emailed to BandOissaquahwagov The City of Issaquah does not allow all the deductions that the State of Washington allows.

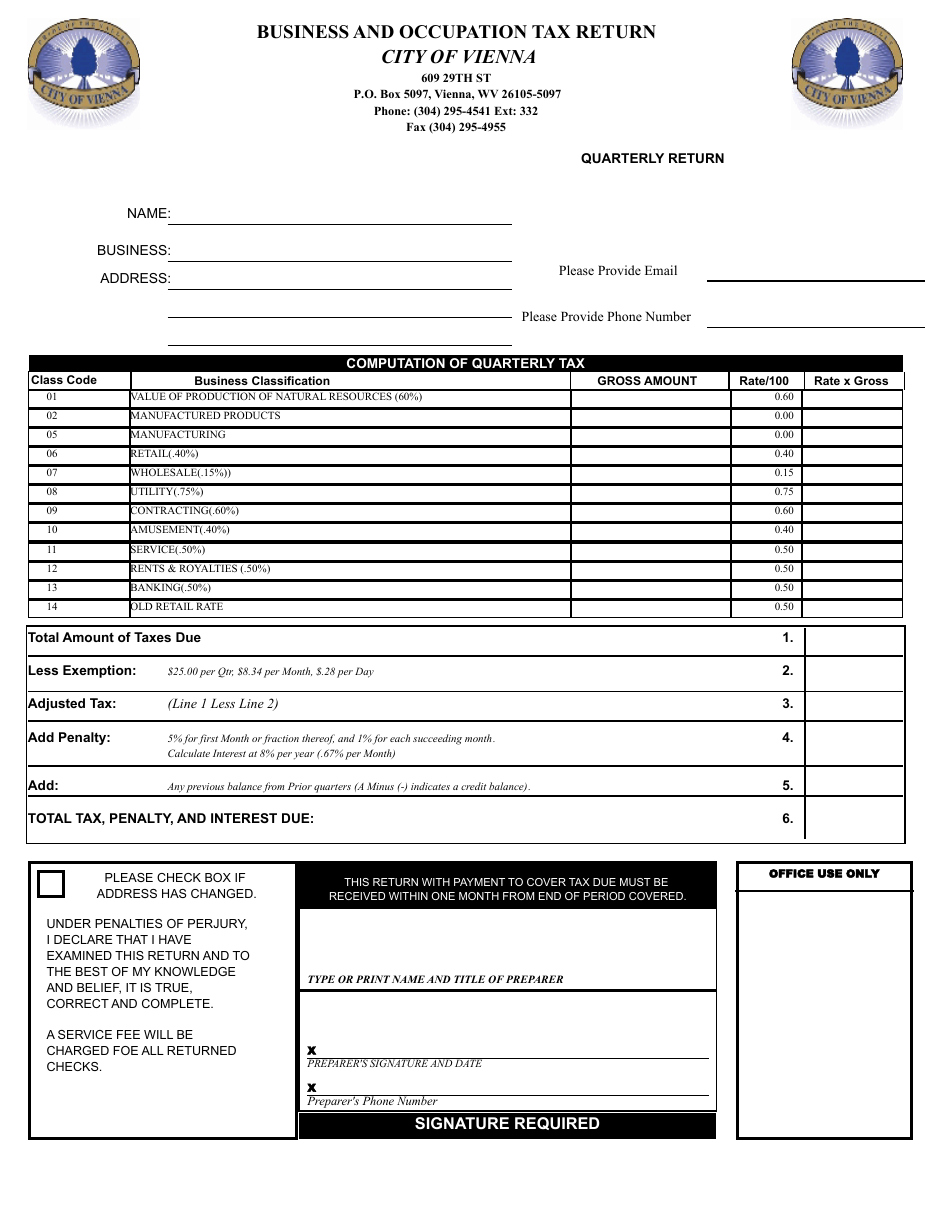

If you are not sure of a deduction contact the City Finance Department. It is measured on the value of products gross proceeds of sale or gross income of the business. Determine your Business Classifications and corresponding rates from the tax table.

What is the business and occupation BO tax. Get Your Max Refund Today. If your business is subject to the BO tax based on the thresholds above you will report file and pay applicable BO taxes either annually or quarterly.

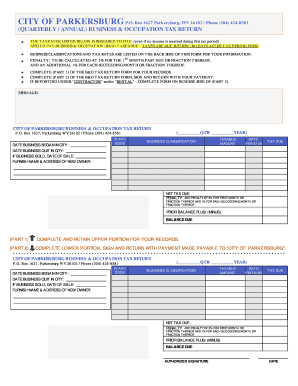

1 Wall Street Ravenswood West Virginia 26164. Businesses choose which way to submit Tax returns. The Citys B O Tax is based on the gross income gross receipts of each business.

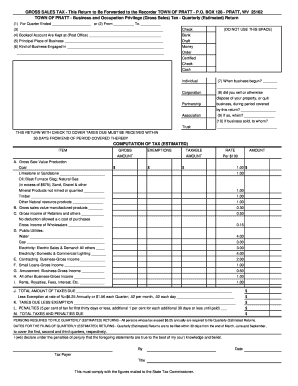

Determine your taxes due by multiplying the rate by the taxable income. Business Occupation BO Tax Our staff will be happy to assist you with any questions or concerns. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787 BO TAX CLASSIFICATIONS AND RATES VARY ACCORDING TO THE TYPE OF BUSINESS.

Minimum penalty on all late returns where tax is due is 500. File and pay BO taxes. Business Taxes and Fees in California Sales Use Tax.

We are available with the exception of holidays Monday through Friday 800 am. However you may be entitled to the. Quarterly BO Tax Form.

29 of the tax due if not received on or before the last day of the second month following the due date. To submit your B O Tax Form follow these instructions. Businesses may be assigned a quarterly or annual reporting period depending on the tax amount or type of tax.

Simplified income payroll sales and use tax information for you and your business. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. The state BO tax is a gross receipts tax.

Mailing and payment instructions are on the Multi-Purpose Tax Return. Add an additional full-timeposition to your Tacomaworkforce. Business Occupation BO Tax The City assesses a business and occupation BO tax of 01 one tenth of one percent on businesses with gross receipts in excess of 200000.

For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC Chapter 5-25 Business. Download the B O Tax form below. If you would like assistance navigating the FileLocal system please call FileLocal directly at.

Annual BO Tax Form. Sign the form and mail in a check payment for the total taxes due by the Quarterly due date. This means there are no deductions from the.

Washington unlike many other states does not have an income tax. Filing Frequency and Due Date. Business And Occupation Tax Return Instructions To avoid a late penalty your Tax Return must be postmarked on or before the due date.

Business as used in the ordinance setting up this tax structure includes all activities engaged in or caused to be engaged in with object gain of economic benefit either direct or indirect. Business and Occupation Tax. Please file your City BO taxes on the FileLocal portal.

Please contact City Hall for the Financial Institution B O Form at 304 472-1651. To 500 pm at 360 491-3212. Mail the form and payment to the City of Ruston 5117 N Winnifred Street Ruston WA 98407.

You must submit a tax return form even if no tax is due. Contact the City Clerk for any questions or concerns at 253 759-3544 option 1. Most businesses have been assigned an annual reporting status for the 2022 tax year.

City Tax Forms City Tax Forms All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes are reported on the Multi-Purpose Tax Return. Costs of doing business are not deductible. Keep that new.

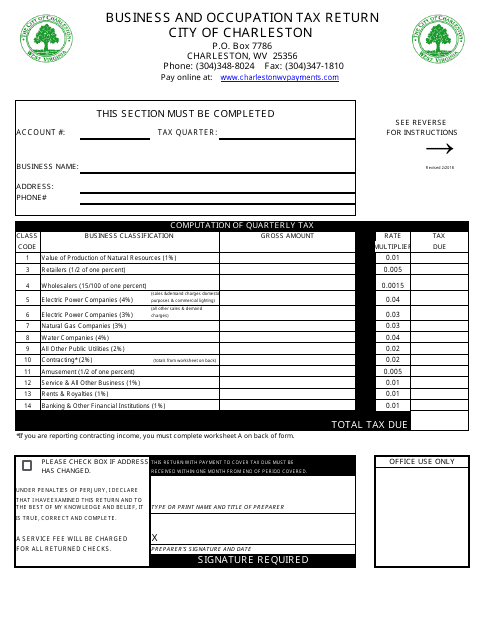

Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. Contracting class instructions are listed below 3. BO Tax Return Form Rental Property Registration Form For Additional Details.

2022 North Mercer RPD Permit Application. Businesses that are required to pay BO tax do not pay the Per Employee Fee. Parking Permits on Mercer Island.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. Complete and return the appropriate form below based on your businesss annual total gross revenue. This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg.

Annual Business and Occupation Tax Return Form PDF By the Job Business and Occupation Tax Return Form PDF. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

CONTACT THE CITY OF WHEELING AT 304-234-3653 FOR ADDITIONAL INFORMATION. If you are unable to file or renew using the FileLocal portal then you can print and mail the tax return. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012.

If you are a monthly filer then the Washington BO tax is due on the 25th of the following month. Town Center and Restricted Parking District RPD 2022 Town Center Parking Permit Application. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

You will receive information about your filing frequency once you have registered with Washington. Your Annual 2022 return will be due April 30 of the following year. There is no penalty on late returns with no tax due.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Pay that new employee at least Family Wageas developed by the Washington State Employment Security Departmentplus benefitscomparable to your industry no matter what kind of job it is.

Fillable Online B O Tax Standard Form City Of Parkersburg Fax Email Print Pdffiller

Form Town Fill Out And Sign Printable Pdf Template Signnow

Tax Everett Form Fill Online Printable Fillable Blank Pdffiller

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller

City Of Vienna West Virginia Business And Occupation Tax Return Download Fillable Pdf Templateroller

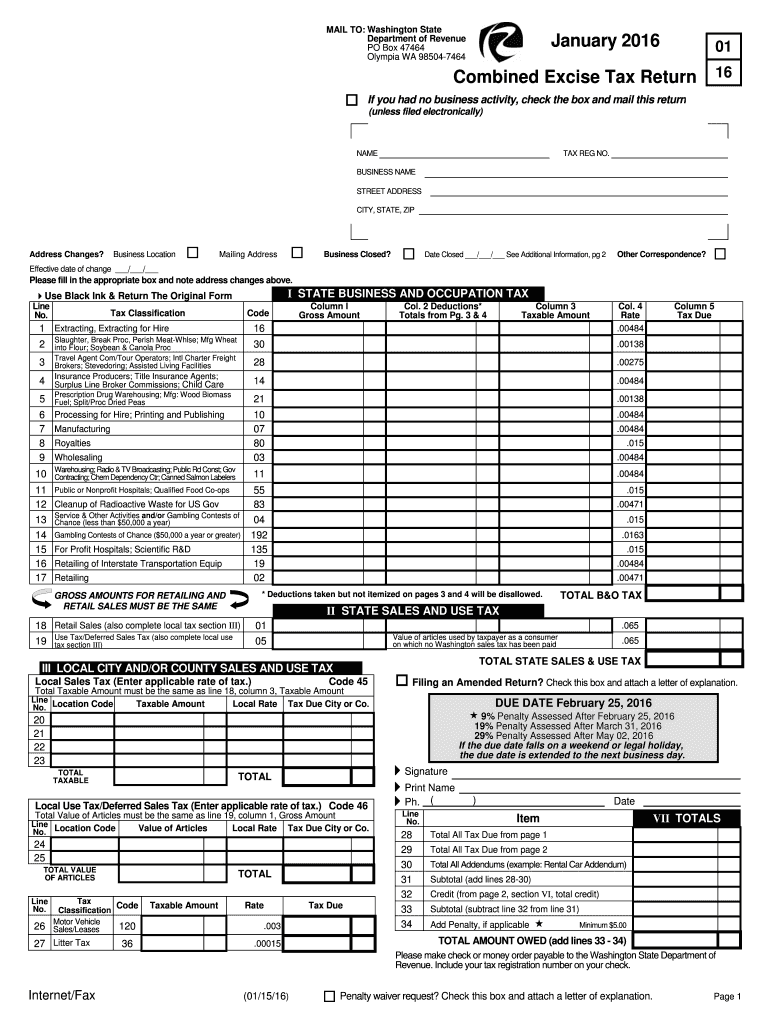

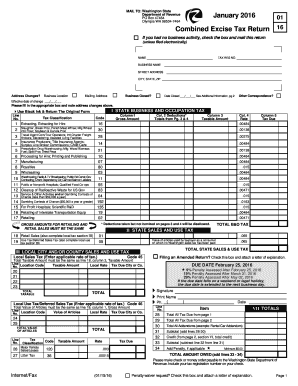

Wa Dor Combined Excise Tax Return 2020 2022 Fill Out Tax Template Online

Wa Dor Combined Excise Tax Return 2016 Fill Out Tax Template Online Us Legal Forms

Tax Everett Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

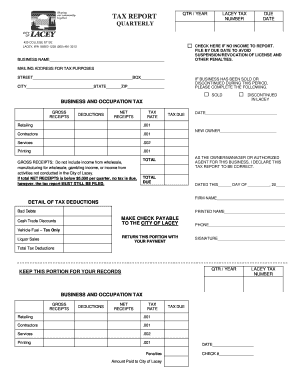

City Of Lacey B O Tax Form Fill Out And Sign Printable Pdf Template Signnow

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

City Of Everett B O Tax Form Fill Online Printable Fillable Blank Pdffiller

B Amp O Tax Return City Of Bellevue

Washington Combined Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow